Metallprisnyheter Maj

The markets have calmed down over the past month. Investors are still cautious, but prices have slowly started to climb upwards again.

Macroeconomic developments

Trump quickly paused his tariffs for 90 days to allow time for negotiations, which calmed the markets down. Both stock and commodity markets have started to rise, and the fear of a recession has faded into the background. But the markets are still very sensitive to any news – either good or bad.

USA

The credit rating agency Moody's has lowered the US credit rating – their assessment of how robust the US economy is.

This is partly due to the rising US national debt and Trump's planned tax cuts, which are only partially financed.

Moody's was the last of the three major credit rating agencies to maintain the highest credit rating of the US.

To make matters worse, US consumer confidence is at its lowest level in 8 years. This may be a sign that private consumption is going to decrease. All while inflation and interest rates remain high.

China

The 30% US tariffs have started to affect Chinese exports.

Industrial production and retail sales are growing less than expected, but retail sales are still at a good level. We expect the numbers to improve in 2-3 months, when companies and consumers have settled into the tariff war.

Europe

The EU has not yet reached an agreement with the US on tariffs, but markets seem confident that a deal is coming.

Growth in Europe is sluggish, and the expectation for 2025 has just been adjusted from 1.5% to 1.1%.

On a positive note, inflation is still going down, which means that the European Central Bank (ECB) is expected to cut interest rates once again. But whether the cuts will continue after that is a point of debate.

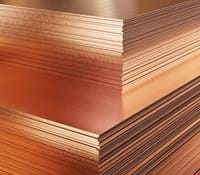

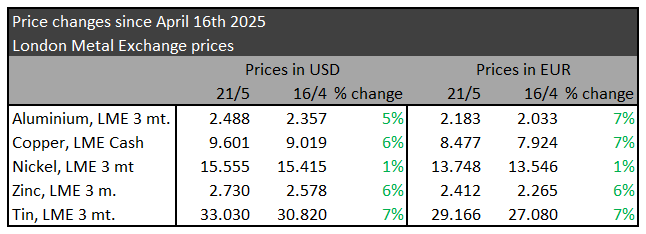

Copper

In the copper market, USD 9,580 is seen as a barrier point that the price may struggle to break through.

Lately, the price has been right around that level, and it is difficult to predict whether it will move up or down from here. If the markets continue to develop as they do right now, we expect the price to be between USD 9,360-9,700.

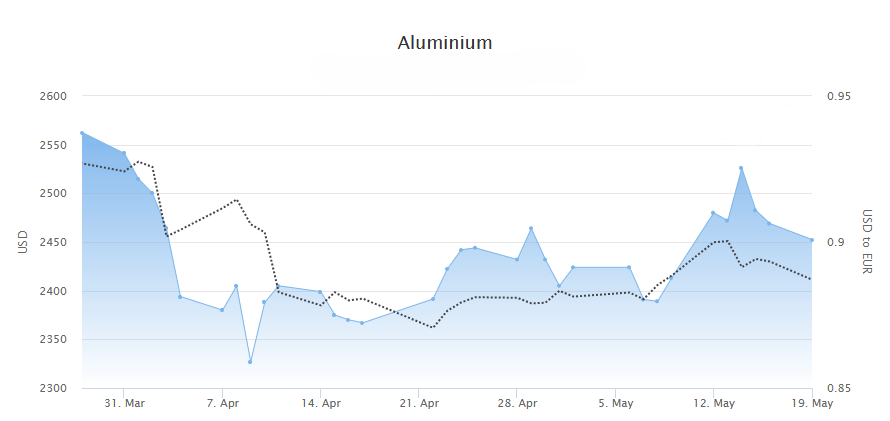

Aluminium

For aluminium, USD 2,500 is a barrier point, and the price is currently struggling to break through this point despite several close calls.

If the aluminium price manages to move above USD 2,500, the next barrier is expected to be USD 2,700.

Stainless steel

The stainless steel market is under pressure.

Prices and demand remain low, and the plants have entered into fierce competition with each other.

In our view, prices should be close to the bottom now and move upwards soon – but it has not happened yet.

Sheets/plates are struggling the most. On bars, the alloy surcharge will decrease by just over 4% on both 4307 and 4404, but otherwise the price is fairly stable.

Tubes and fittings have not hit the same low level yet, but it is probably a matter of time.

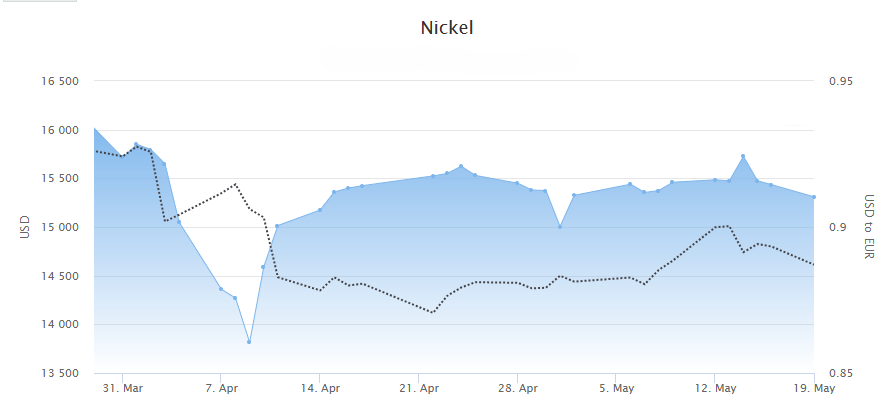

Nickel

In recent months, we have believed that nickel was at the lowest possible level. This turned out to be wrong – the price has fallen even more. During the course of April, the dollar price of nickel fell by 7% overall.

This may be an indication that the market for recycled material is now so large that the need for new nickel has fundamentally changed. Perhaps this price is the new reality for nickel – only time will tell.